Climate change is one of the most pressing challenges facing the world today. Rising temperatures, unpredictable weather, and increasing natural disasters are no longer future threats—they’re happening now. To deal with this crisis, we need solutions that are not only effective but also realistic. Carbon trading is one such solution. It allows governments and companies to reduce emissions using a system that puts a price on pollution. This approach is already working in several countries and has opened the door to new ways of combining business with climate action.

Exploring the Concept of Carbon Credit

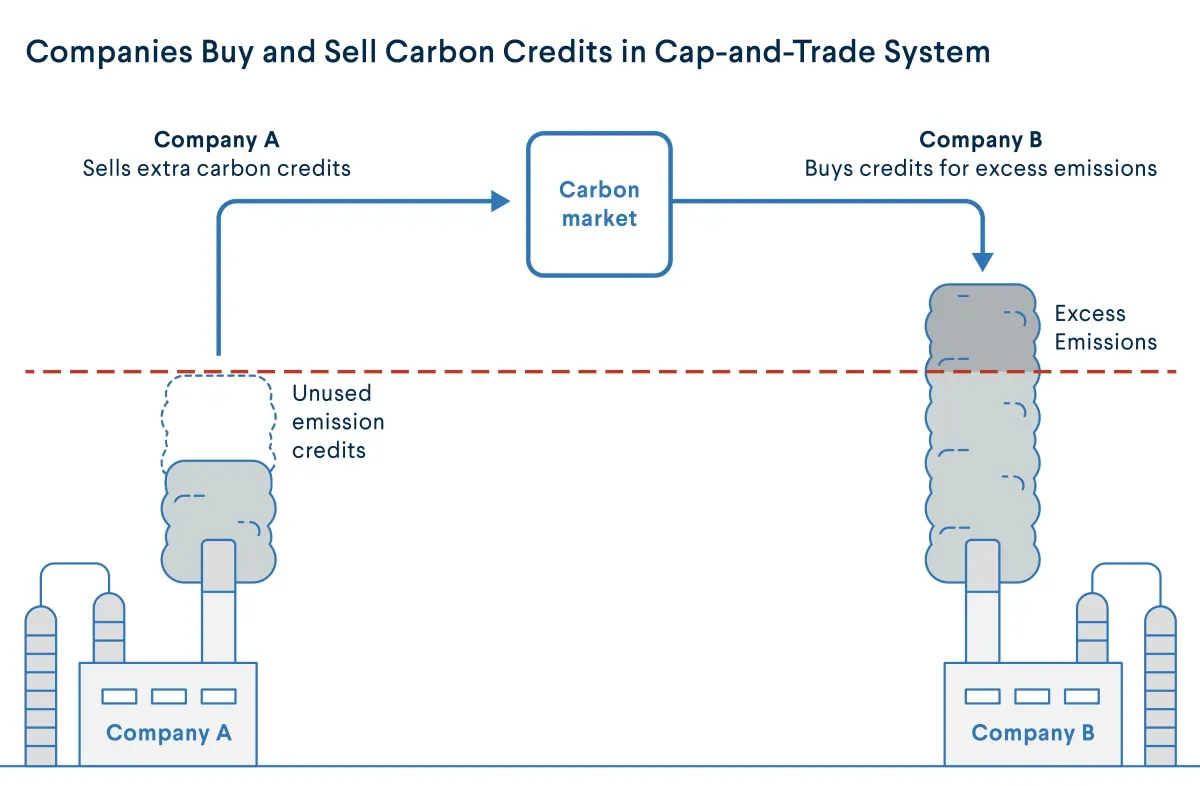

Carbon trading, also known as carbon emissions trading, is a market-based approach to reducing greenhouse gas (GHG) emissions. It allows countries, companies, or organizations to buy and sell permits that represent the right to emit a certain amount of carbon dioxide or other greenhouse gases. Carbon emissions trading operates under a cap-and-trade system where governments or organizations set a limit (cap) on total emissions. Companies receive or buy carbon credits, which allow them to emit a certain amount of CO₂. If a company emits less than its allowance, it can sell its excess credits to others. If a company exceeds its limit, it must buy more credits or face penalties. This creates a financial incentive to reduce emissions—pollute less, profit more.

There are two main types of carbon trading systems:

Cap-and-Trade Systems: Governments set an overall emissions cap and distribute or auction allowances to polluters. Companies can then buy or sell these allowances depending on whether they have surplus or deficit

Baseline-and-Credit Systems: Emitters who reduce emissions below a predetermined baseline earn credits, which they can sell to others who cannot meet their targets.

How to Produce Carbon Credits

Many different types of businesses can create and sell carbon credits by reducing, capturing, and storing emissions through different processes.

Some of the most popular types of carbon offsetting projects include:

- Renewable energy projects,

- Improving energy efficiency,

- Carbon and methane capture and sequestration

- Land use and reforestation.

The European Union Emissions Trading System (EU ETS) is one of the largest and most successful examples. Since it started in 2005, it has helped reduce emissions from power plants and factories by over 35%. The system is strict, regularly lowering the emission limits to ensure progress. In the United States, California’s Cap-and-Trade Program is also working well. It covers major industries and has helped the state lower its emissions while growing its economy. Other countries, including Canada, New Zealand, China, and South Korea, have also implemented or piloted carbon trading programs. China’s national carbon market, which launched in 2021, is now the largest in terms of emissions covered, targeting mainly the power generation sector. Even tech giants like Google, Apple, and Microsoft are participating in voluntary carbon markets, buying carbon credits to offset their environmental impact—especially for emissions they can’t avoid.

From the Perspective of Bangladesh:

In terms of emissions, Bangladesh is not a major emitter of carbon, but it’s one of the countries most affected by climate change—through rising sea levels, floods, and storms. Although the country doesn’t yet have a national carbon trading market, it has participated in international carbon credit systems through small renewable energy and clean development projects. There’s great potential for Bangladesh to expand its role in the global carbon market. For example, promoting solar energy, biogas, or improved cooking stoves in rural areas can reduce emissions and generate carbon credits. These can be sold to international buyers, bringing in funding for sustainable development.

Challenges and Criticisms:

Despite its benefits, carbon trading faces some challenges. One of the main concerns is that Carbon trading can create the risk of “Greenwashing”; which means some companies may buy credits instead of making real emission cuts. Price volatility is another challenge in carbon emissions trading. Carbon credit prices fluctuate, making it uncertain for businesses. Enforcement issues can also hinder the process of carbon trading in many countries. Weak regulations or loopholes can allow companies to exploit the system. In some cases, projects that generate credits (like tree plantations) may not deliver the promised carbon savings or may harm local communities. Another issue is that wealthy countries or corporations might just buy their way out of responsibility, while poorer regions suffer the worst climate impacts. That’s why transparency and strong regulation are essential to make carbon trading truly effective.

In a world where climate change demands urgent action, market-based solutions like carbon trading offer flexibility, innovation, and accountability. Carbon trading isn’t a silver bullet—but it’s a smart step toward balancing economic growth and environmental responsibility. By putting a price on pollution, it pushes companies to act more sustainably—not out of obligation, but out of incentive. Overall, in terms of climate urgency, smart market tools like carbon credits are no longer optional- they are essential.